In this issue

Filing trends

The question of where and when to file for IP protection is always a key strategic decision. Economic trends, politics, and jurisprudence all intersect with budgets and long-term business goals in an ever-changing calculus. To get a clearer picture of the forces at play in the biocontrol/biopesticide/biostimulant areas, we examined the United States Patent and Trademark Office’s (USPTO’s) Patent and Application Search features for U.S. patents issuing and U.S. applications publishing in this technological area for the same five-month period in late 2019 and late 2015. Several interesting trends emerged.

Applicants

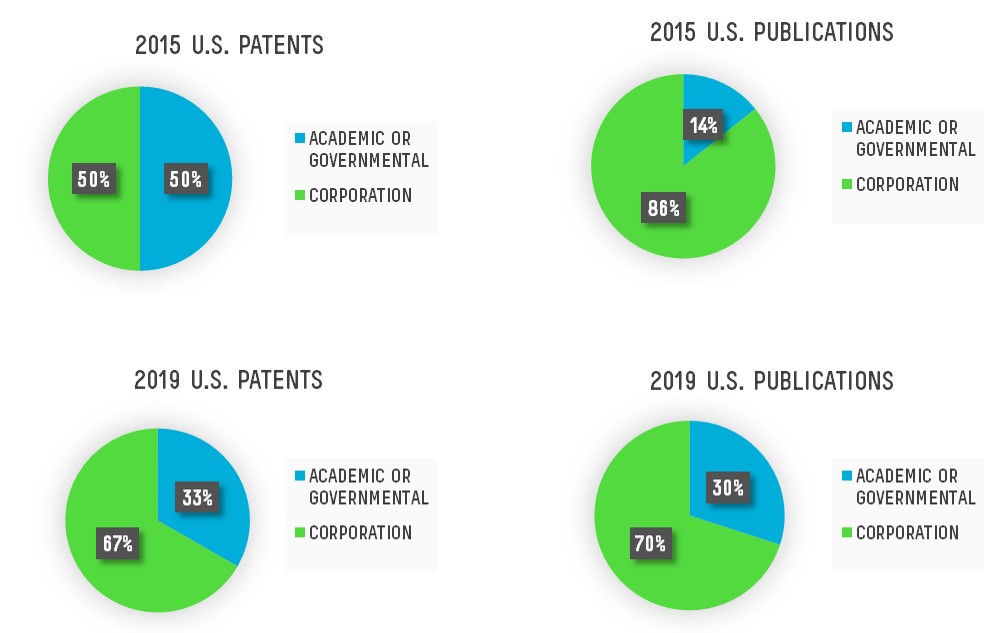

We looked first at who the applicants were, categorizing them as corporate or academic/governmental.

Overall, it appears that corporate entities are becoming the supermajority of filers in this sector. The spike in 2015 publication corporate applicants is in part due to a striking flurry of activity from Bayer CropScience AG, but a perfectly smooth trend line does not emerge even if Bayer CropScience AG is disregarded. Notably, academic/governmental entities are a smaller percentage of the publishing groups than the issuing groups. Thus, while corporate entities are more prevalent, academic/governmental entities are somewhat more likely to see their filings through successfully to patenting.

We also looked at where applicants were located. Information was obtained from both Google Patent information and WIPO’s database. Given the scope of this alert, we categorized applicant locations as “U.S.,” “EPO” (European Patent Office member states), and “Other.” These sacrifices of granularity were made simply due to the scope of this alert.

In 2015, U.S.-based applicants had a significantly higher percentage of the issuing patents, as compared to published applications. This disparity disappeared by 2019 when the three geographic categories of applicants maintained steady representation between publication and issuance. Most of the variance seen in the 2015 publication data, as compared to the other charts, appears to be due to the considerable activity from Germany’s Bayer CropScience AG at that time, rather than larger regional trends. Using these three geographical categories, the geographic distribution of applicants appears rather steady both in activity and relative success in obtaining IP protections. We do note, however, that the use of the Other category conceals considerable diversity, with generally only one or two data points per individual Other country in each graph. The Other category reflects a broad landscape in which no dominating players were immediately evident, in significant contrast to the U.S. and EPO categories.

Filing decisions

The international legal families of U.S. patents and publications were investigated to observe the world-wide strategies applicants were pursuing.

The following trends are discernable from this data:

- Early-stage applicants (publishing stage) are electing to file in fewer jurisdictions, a trend likely to only be intensified by the events of 2020.

- Applicants with the means and will to file in numerous jurisdictions are a greater percentage of those who make it to issuance. Whether this reflects either greater commitment to and/or resources available for successful prosecution, or savvy decisions to limit the number of filings for applications that are likely to be abandoned is more difficult to ascertain.

We also looked at which jurisdictions were most commonly represented in the filings made outside of the U.S.

The patterns in this data set raise the issue of whether certain patterns are trends over time or trends reflecting the strategies of successful vs. unsuccessful filings. For instance, the decrease in Canadian filings from the 2019 patents to the 2019 applications could represent a fairly recent decrease of interest in Canadian IP protection. Alternatively, the disparity could represent a scenario in which applicants who have the means and motivation to bring their U.S. applications to issuance can apply that same means and motivation to Canadian filing questions.

That said, it appears that interest in biocontrol/biopesticide/biostimulant filings in Japan has generally been cooling, while Canada, Mexico, Australia, China, Russia, and New Zealand are some of the previously standard jurisdictions which are being increasingly opted out of most recently as portfolio sizes shrink. Interest in EPO, Brazilian, Argentinian, and Chilean filings are holding steady in this sector.

Conclusions

These snapshot perspectives on IP activity should, of course, be interpreted with caution, but appear to indicate:

- Corporate players are slowly becoming the overwhelming source of IP in the biocontrol/biopesticide/biostimulant area, at the expense of academic and governmental entities.

- The U.S. and EPO countries have a steady presence in biocontrol/biopesticide/biostimulant IP, while the landscape outside of those jurisdictions is still quite fluid.

- Patent filers have become more restrained in their worldwide filing decisions, but successful filers are usually those who also maintain a global perspective and presence.